The following analysis of select counties of the Utah real estate market is provided by Windermere Real Estate Chief Economist Matthew Gardner. We hope that this information may assist you with making better-informed real estate decisions. For further information about the housing market in your area, please don’t hesitate to contact your Windermere agent.

ECONOMIC OVERVIEW

According to the Labor Department, Utah has added 51,800 non-agricultural jobs over the past 12 months, representing a very solid growth rate of 3.5%, which makes Utah the fastest growing state in the country. For perspective, the U.S growth rate is running at 1.6%. Monthly employment gains in Utah have averaged 4,125 new jobs per month so far in 2018 and I believe we will end the calendar year having added more than 50,000 new jobs. In August, the state unemployment rate was 3.1%, down from 3.2% a year ago.

HOME SALES ACTIVITY

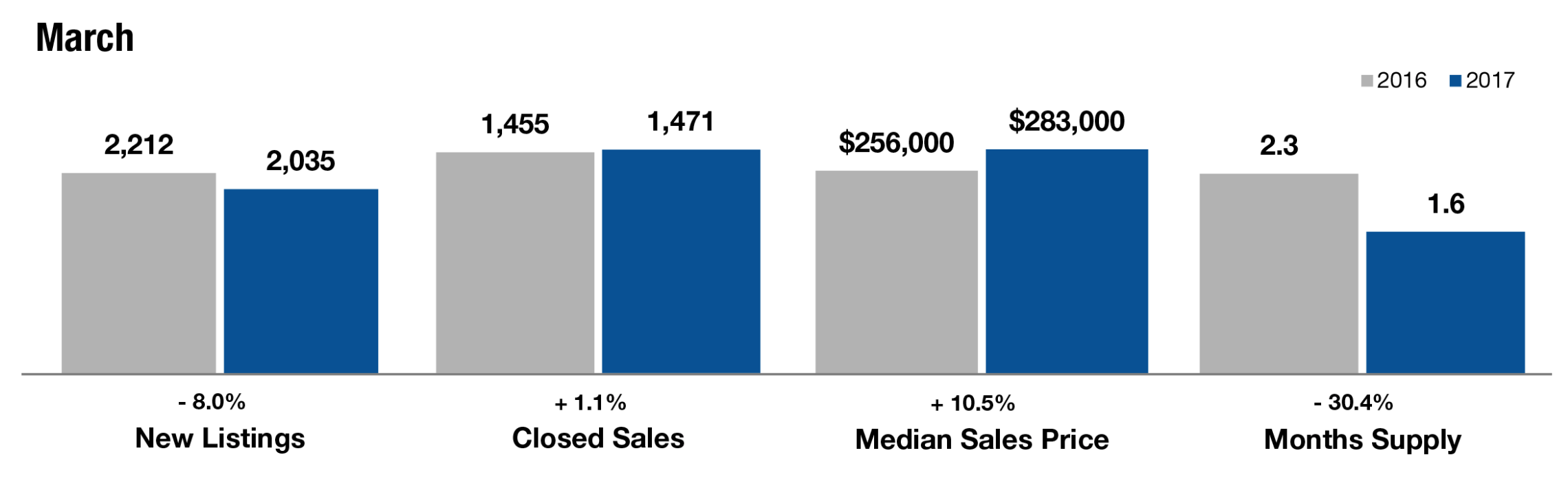

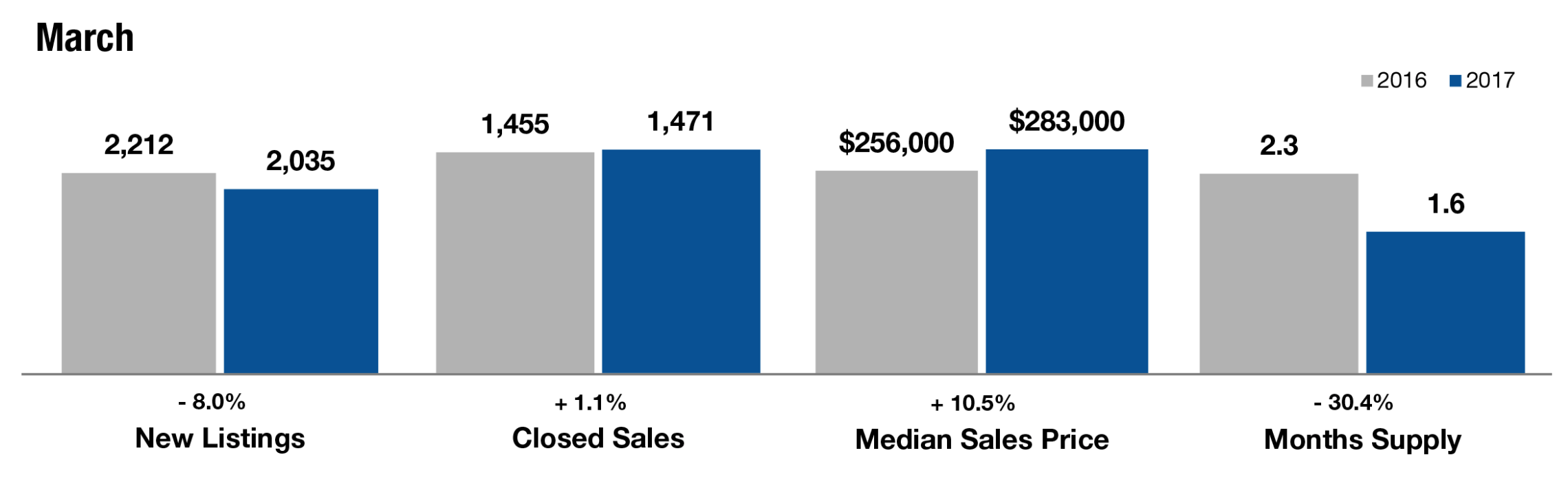

- 9,589 homes sold during the third quarter of 2018, representing a drop of 5.7% from the same period in 2017.

- Total sales activity rose in Wasatch County but dropped in the rest of the markets contained in this report.

- Interestingly, and unlike almost all the Western states, listing activity continues to run at well below historical averages in Utah, which has been limiting the number of home sales. That said we saw a significant increase in the number of listings between the second and third quarters.

- The supply of homes for sale appears to be rising, which could allow sales to increase. However, affordability issues may slow sales going forward even as we see more homes come onto market.

HOME PRICES

- The average home price in the region continuedto rise in the third quarter, with a year-over-year increase of 8.6% to $368,654.

- In addition to Wasatch County, just one county saw double-digit price increases when compared to a year ago; last quarter there were four.

- Appreciation was strongest in Wasatch County, where home prices rose by a substantial 17.9%. Although this sounds extreme, it is a very small market and subject to major swings.

- The takeaway from this data is that home prices, which have been appreciating at above-average rates for several years, are likely to see a slowdown as we move through the winter and into 2019.

DAYS ON MARKET

- The average number of days it took to sell a home in Utah dropped five days compared to the third quarter of 2017.

- Homes sold fastest in Davis and Weber Counties and slowest in Summit County. All counties, other than Salt Lake (+1), saw the days on market drop when compared to the third quarter of 2017.

- During the third quarter of this year, it took an average of 38 days to sell a home in the region.

- Housing demand remains quite robust, but the expected increase in inventory will give buyers more choice and less urgency. This could lead to market time rising.

CONCLUSIONS

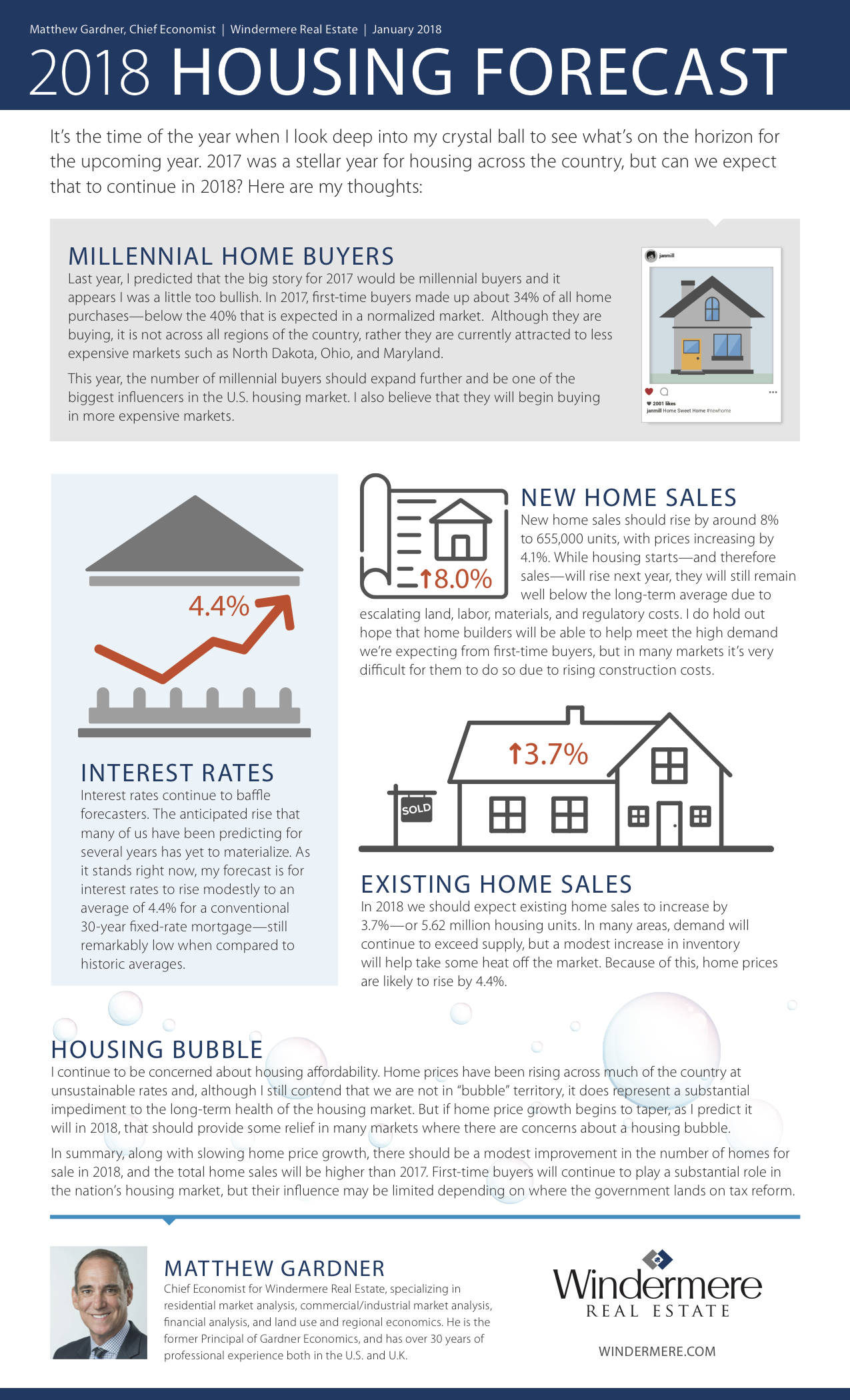

This speedometer reflects the state of the region’s real estate market using housing inventory, price gains, home sales, interest rates, and larger economic factors.

For the third quarter of 2018, I have nudged the needle a little more in favor of buyers; however, we are far from being in a balanced market. Well-positioned and well-priced homes will still attract a lot of attention, but rising inventory and housing affordability are likely to act as modest headwinds to total sales and home price growth.

Mr. Gardner is the Chief Economist for Windermere Real Estate, specializing in residential market analysis, commercial/industrial market analysis, financial analysis, and land use and regional economics. He is the former Principal of Gardner Economics and has more than 30 years of professional experience both in the U.S. and U.K.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link

Given the considerable competition for the few homes for sale in the fourth quarter, prices continue to rise at fairly rapid rates. Prices in the region were up 11.6% yearover-year to an average of $342,507.

Given the considerable competition for the few homes for sale in the fourth quarter, prices continue to rise at fairly rapid rates. Prices in the region were up 11.6% yearover-year to an average of $342,507.

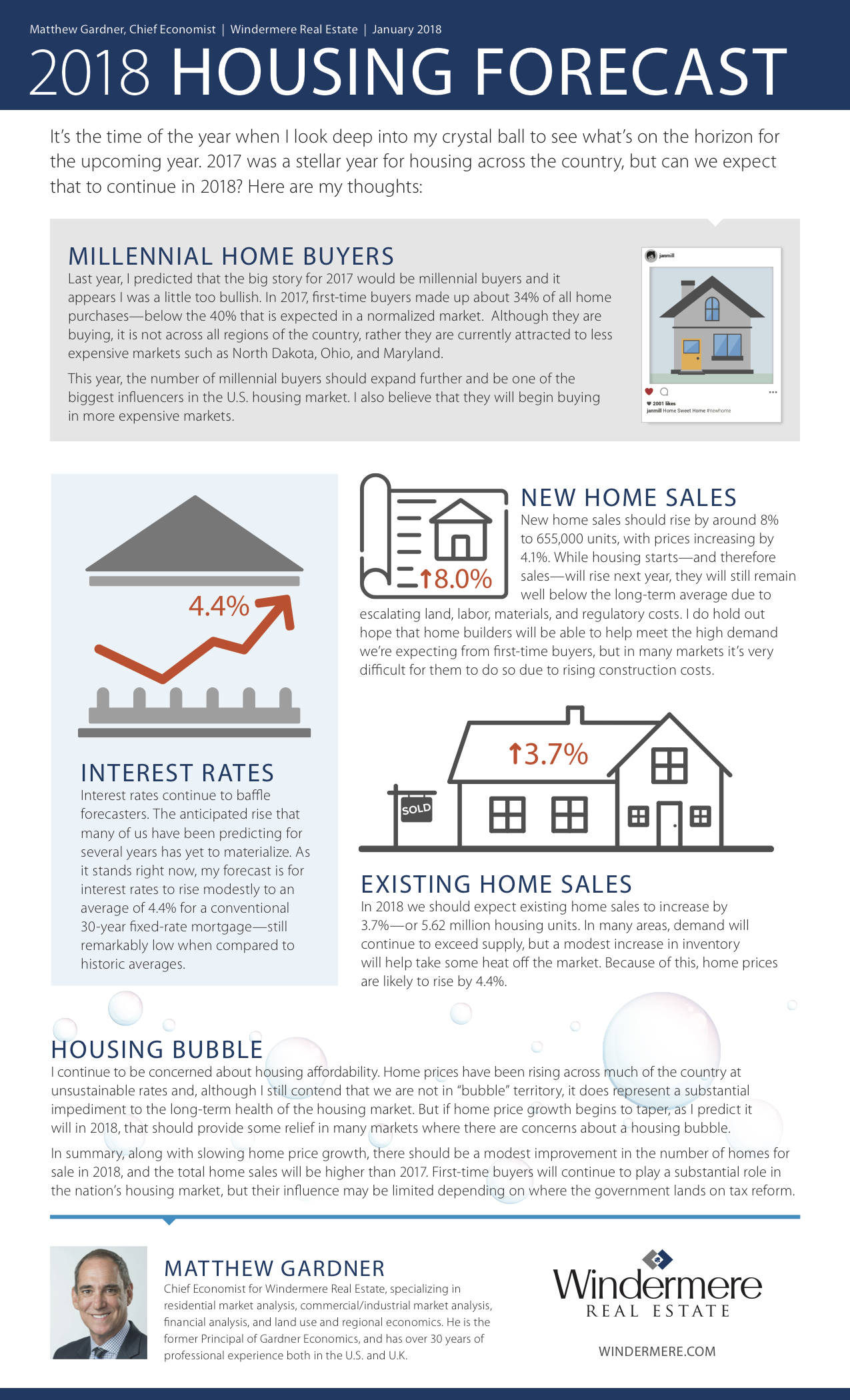

This speedometer reflects the state of the region’s housing market using housing inventory, price gains, home sales, interest rates, and larger economic factors. For the fourth quarter of 2017, I left the needle at the same point as third quarter. Supply issues persist and this continues to create competition for well-priced and well-located homes. The increase we’re seeing in the amount of time it takes to sell a home may suggest that the market is either getting weary of all the competition or buyers are delaying their purchase until there are more homes to choose from.

This speedometer reflects the state of the region’s housing market using housing inventory, price gains, home sales, interest rates, and larger economic factors. For the fourth quarter of 2017, I left the needle at the same point as third quarter. Supply issues persist and this continues to create competition for well-priced and well-located homes. The increase we’re seeing in the amount of time it takes to sell a home may suggest that the market is either getting weary of all the competition or buyers are delaying their purchase until there are more homes to choose from.